Step-by-Step PAN–Aadhaar Link 2025

Latest Rules, Deadline Extension, ₹1,000 Fee & Complete Online Process

Learn how to link PAN with Aadhaar online using the Income Tax website, new rules for 2025, penalties, exemptions, and solutions for common problems.

This website (pancarddownload.app) is an independent informational platform.

- We are not affiliated with the Income Tax Department, NSDL, Protean, or UIDAI.

- All content here is for educational and awareness purposes only.

- Always verify details on the official government website.

Official Website: official Income Tax website

PAN–Aadhaar Link Latest Update in India (November 2025)

The Government of India has announced an extension of the PAN–Aadhaar link last date. According to CBDT Notification No. 26/2025, individuals who were allotted PAN using an Aadhaar Enrolment ID before 1 October 2024 can now complete the linking process by 31 December 2025.

| Key Date | Detail |

|---|---|

| 🗓️ PAN–Aadhaar Link Last Date | 31 December 2025 |

| 🚫 PAN Inoperative From | 1 January 2026 |

| 💰 Late Fee (if applicable) | ₹1,000 |

⚠️ Important: If you fail to link your PAN and Aadhaar by this new deadline, your PAN may become inoperative — meaning it cannot be used for income tax filing, banking, or investments until it's reactivated.

Why PAN–Aadhaar Linking Is Mandatory in 2025

PAN (Permanent Account Number) and Aadhaar are both essential identification tools for Indian citizens.

Linking them helps ensure:

- No duplicate or fake PANs

- Transparent tax filing

- Seamless income tax verification

- Compliance with Section 139AA of the Income Tax Act

Note:

Each Aadhaar can be linked to only one PAN. Having multiple PANs or not linking Aadhaar may lead to penalties under Section 272B.

Step-by-Step Process: How to Link PAN with Aadhaar (Online)

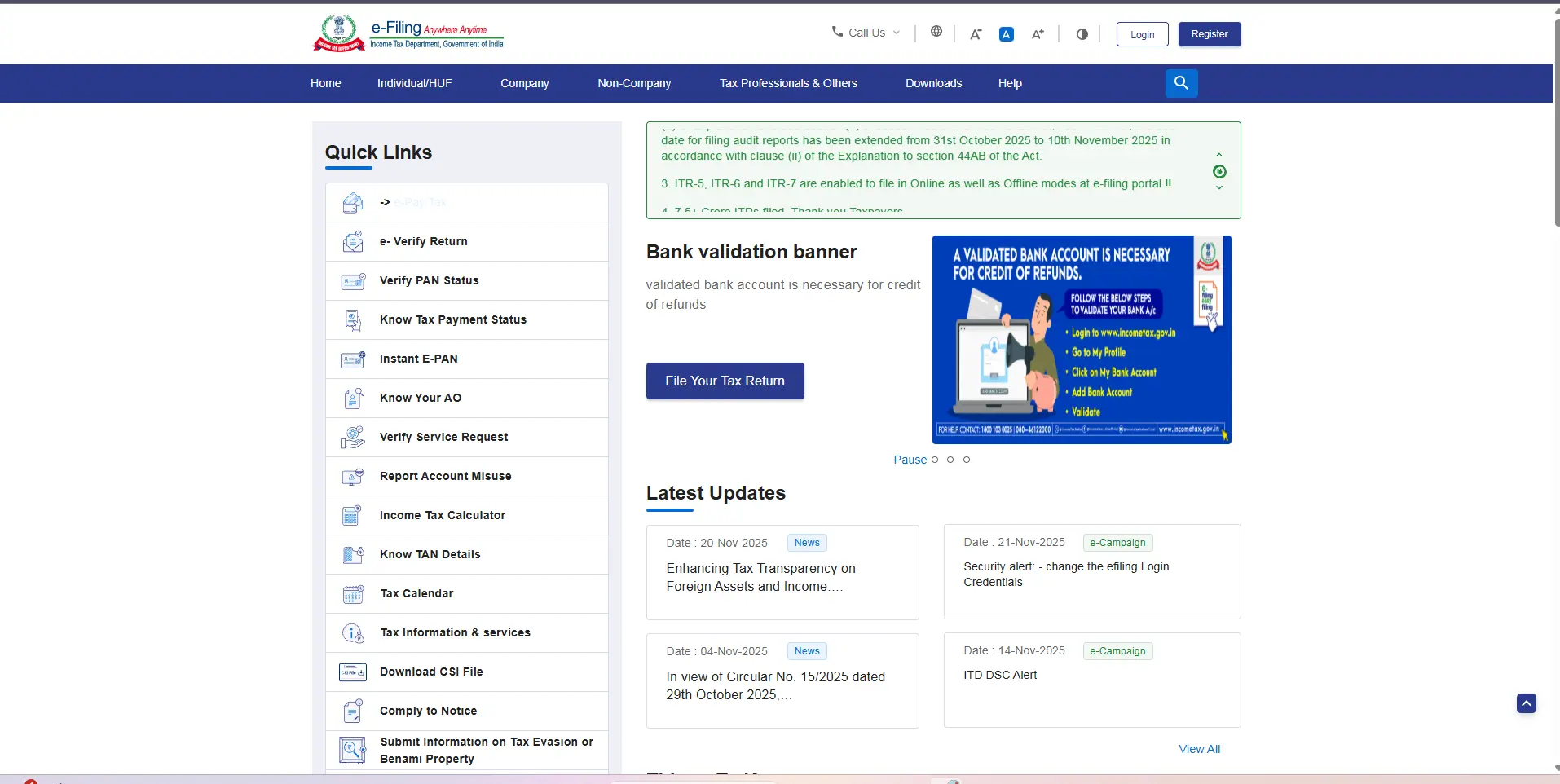

You can link PAN and Aadhaar using the Income Tax e-Filing website. Follow this updated 2025 step-by-step guide:

Click Link Aadhaar

Under "Quick Links," click Link Aadhaar

Enter Details

Enter your PAN, Aadhaar number, and name as per Aadhaar

Pay Fee (if applicable)

If a late fee applies, proceed to pay ₹1,000 via e-Pay Tax → Challan ITNS 280 → Minor Head 500 (Other Receipts)

Verify via OTP

Verify via OTP sent to your Aadhaar-linked mobile number

Confirmation

A confirmation will appear: "Your PAN and Aadhaar are successfully linked."

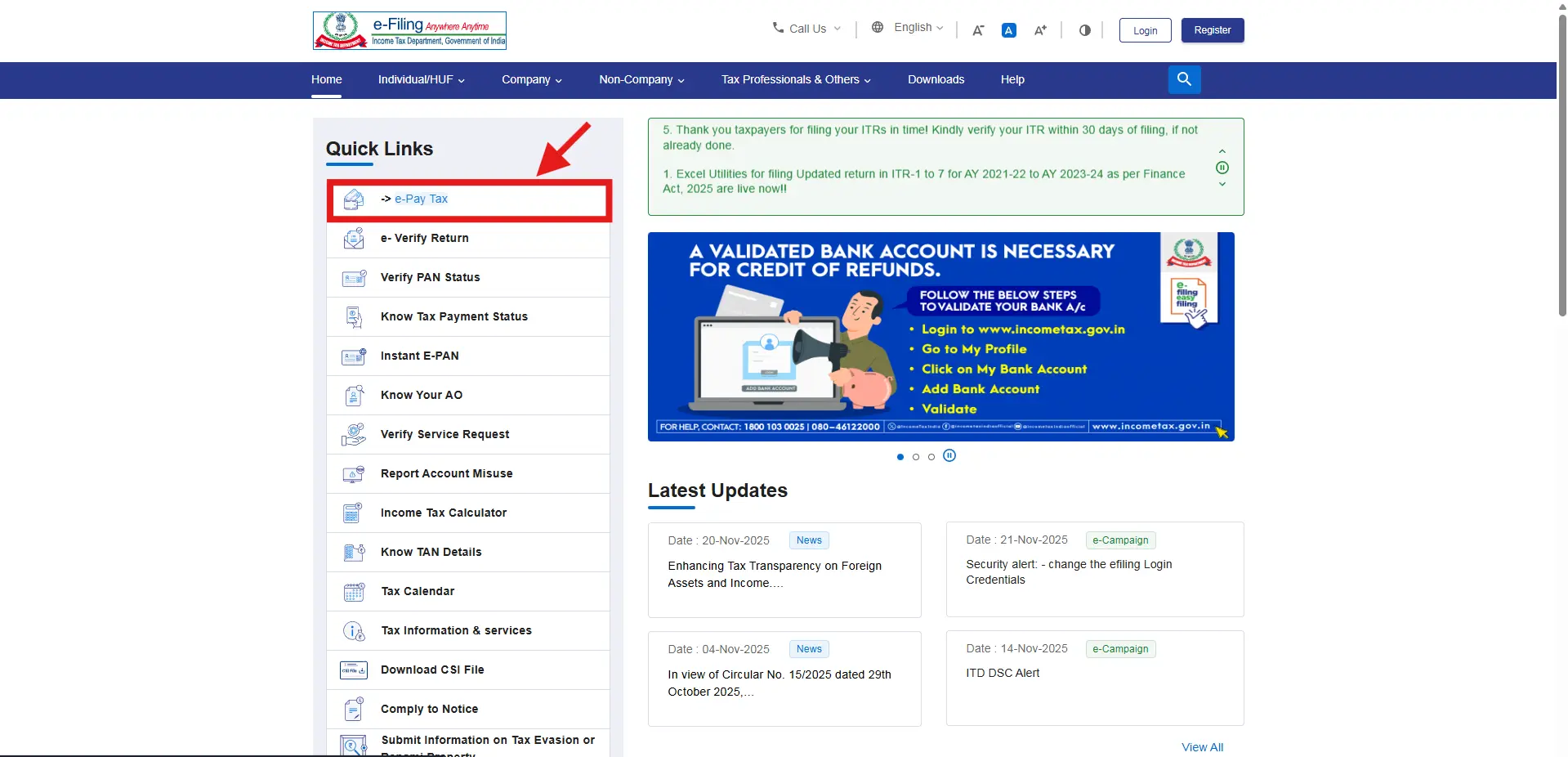

How to Pay ₹1,000 PAN–Aadhaar Link Fee (Official Method)

If the system prompts you for payment, follow these steps:

Click e-Pay Tax

Click e-Pay Tax → Continue

Enter PAN and Validate

Enter your PAN and validate with OTP

Select Assessment Year

Select Assessment Year 2025–26

Choose Minor Head

Choose Minor Head 500 – Other Receipts

Enter Amount and Pay

Enter ₹1,000 and pay via Net Banking / UPI / Debit Card

Save Receipt

Save your receipt, then wait 24–48 hours before linking

Note:

The ₹1,000 fee applies mainly to late linkings. Taxpayers under the December 2025 extended category may not be charged if linking before the deadline.

How to Link PAN Card to Aadhaar Card via SMS

You can also link your PAN and Aadhaar through an SMS:

Send to 567678 or 56161:

Format:

UIDPAN <12-digit Aadhaar> <10-digit PAN>

Example: UIDPAN 123456789012 ABCDE1234F

✅ You'll receive a confirmation reply once the linking request is accepted.

PAN–Aadhaar Link for New PAN Card 2025

Aadhaar verification will be mandatory for all new PAN applications.

This means no new PAN card will be issued unless the applicant verifies their Aadhaar number.

This rule ensures every taxpayer's identity is unique and prevents duplicate PANs.

Check If PAN Is Linked with Aadhaar

To verify your PAN–Aadhaar link status:

Visit Income Tax Website

Visit the official Income Tax website

Click Link Aadhaar Status

Under Quick Links, click Link Aadhaar Status Under Quick Links, click Link Aadhaar Status

Enter Details

Enter your PAN and Aadhaar numbers Enter your PAN and Aadhaar numbers

Check Status

You'll see: Your PAN is already linked with Aadhaar, or Your PAN is not linked with Aadhaar. You'll see: Your PAN is already linked with Aadhaar, or Your PAN is not linked with Aadhaar.

Linked

Your PAN is already linked with Aadhaar

Not Linked

Your PAN is not linked with Aadhaar

PAN–Aadhaar Link Problems and Solutions

| Common Issue | Solution |

|---|---|

| Name Mismatch | Update your name in PAN or Aadhaar before linking |

| DOB Mismatch | Correct the date of birth in one document |

| Invalid OTP | Ensure Aadhaar mobile number is active and updated |

| Payment Not Reflecting | Wait 24–48 hours after payment and retry |

| Technical Error | Clear cache or try later during off-peak hours |

💡 Tip:

If your PAN becomes inoperative, you can reactivate it by completing linking and paying the fee (if required). Status usually updates within 3–7 working days.

Consequences of Not Linking PAN and Aadhaar

If your PAN becomes inoperative from 1 January 2026:

You cannot file your Income Tax Return (ITR)

TDS/TCS may be deducted at higher rates

Banks and mutual funds may reject KYC or transactions

You may face loan or investment delays

Linking your PAN and Aadhaar ensures smooth tax filing, proper TDS credit, and uninterrupted financial services.

Aadhaar–PAN Link on the Government Website

Always use only the official Income Tax e-Filing website.

Important:

- • Avoid third-party portals or unofficial payment links.

- • The government does not authorize private websites to accept linking payments.

Quick Summary

| Parameter | Details |

|---|---|

| New Deadline | 31 December 2025 |

| PAN May Become Inoperative From | 1 January 2026 |

| Linking Fee | ₹1,000 (if applicable) |

| Mandatory Aadhaar for New PAN | From 1 July 2025 |

| Exemptions | NRIs, Assam, Meghalaya, J&K |

| Official Website | incometax.gov.in |

Related Links

Conclusion

The PAN–Aadhaar link process 2025 is crucial for every taxpayer to maintain valid financial and tax records.

With the government extending the deadline to 31 December 2025, taxpayers have ample time — but it's best to link now to avoid last-minute errors and delays.

Visit the official Income Tax website today and complete your PAN–Aadhaar linking safely online.

Author: PAN Card Download App Team

Last Updated: November 2025