Download PAN Card Online Telangana – Complete Guide to Download e-PAN Card

Residents of Telangana can now download their PAN card online quickly using NSDL, UTIITSL, Aadhaar-based services, and the Income Tax e-Filing portal. Whether you need to download PAN card PDF, download PAN card through PAN number, or download UTI PAN card, the ePAN facility allows you to download e-PAN card instantly in PDF format. You can also download PAN card image from the e-PAN PDF.

Download your PAN Card Online in Telangana via NSDL, UTIITSL, or Aadhaar-based ePAN. Get your PAN PDF download instantly in just a few steps. You can also download online PAN card status to track your application.

This guide explains the step-by-step process to download PAN card in Telangana, including fees, common issues, and FAQs. If you don't have a PAN yet, learn how to apply for PAN card through NSDL or apply via UTIITSL.

This guide will help you:

- Download ePAN instantly using Aadhaar

- Get a duplicate PAN card PDF if your card is lost or damaged

- Download PAN by Name, Date of Birth, or PAN Number

- Understand fees and charges for reprinting

- Fix common download errors

PAN Card Download PDF Telangana

A PAN card (Permanent Account Number) is essential for filing taxes, banking, investments, and financial services. Residents of Telangana can download their PAN card PDF online through government-authorized portals. If you don't have a PAN yet, learn how to apply for PAN card through NSDL or apply via UTIITSL.

Important: The downloaded ePAN is digitally signed and valid across India.

ePAN Card Download Telangana Online

The ePAN is an electronic version of your PAN card issued digitally by the Income Tax Department. After downloading, make sure to link your PAN with Aadhaar to keep it active.

Benefits of ePAN:

- Instant download in PDF format

- Free for Aadhaar-based PAN (first-time issue)

- Accepted for all legal, financial, and official purposes

Download PAN Card Online in Telangana

You can download PAN card in Telangana through these official portals. If you need to correct details on your PAN card after downloading, you can do so online. You can download PAN card in Telangana through:

NSDL (Protean) Portal

Official NSDL ePAN download service

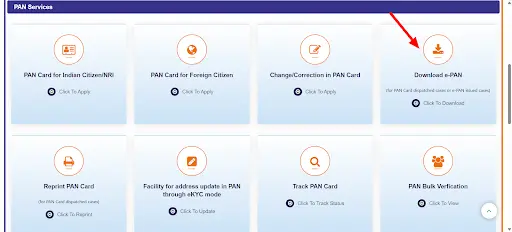

UTIITSL Portal

Official UTIITSL ePAN download service

Aadhaar-based Instant ePAN Service

Instant PAN using Aadhaar verification

Income Tax e-Filing Portal

Direct from Income Tax Department

NSDL PAN Card Download Telangana

The NSDL (Protean) portal allows ePAN downloads for PANs processed through NSDL. For new PAN applications, check our NSDL PAN application guide.

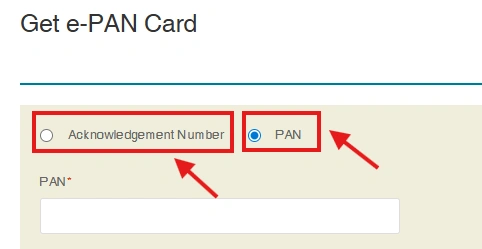

NSDL ePAN Download Telangana Step by Step

- 1Visit the NSDL ePAN Download Portal

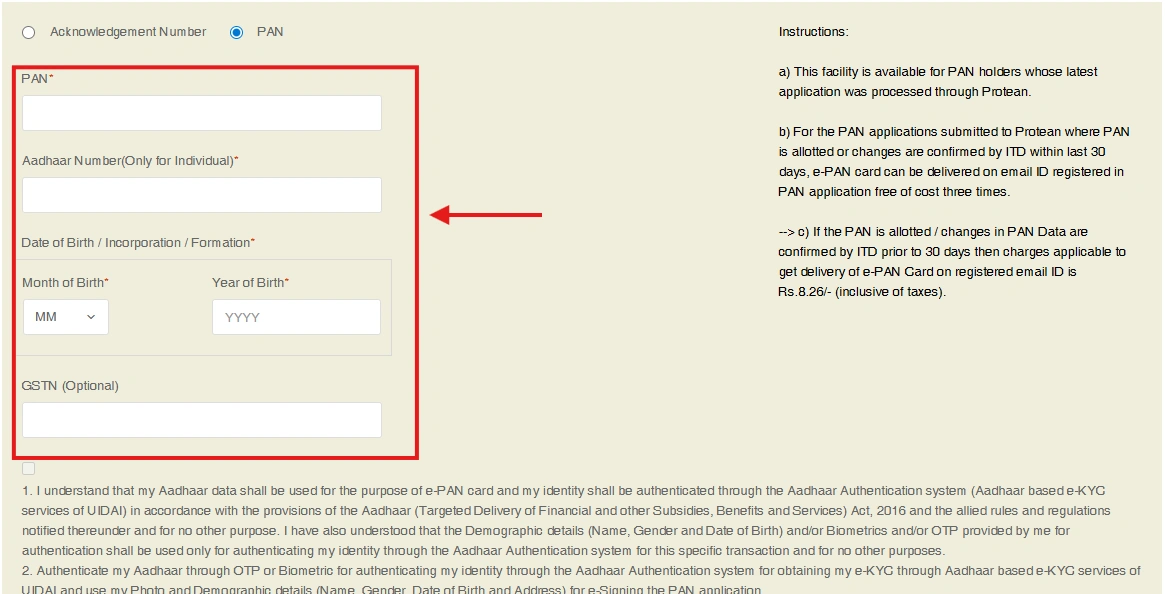

- 2Select Download using PAN / Aadhaar / Acknowledgement NumberSelect the appropriate option based on what information you have available.

- 3Enter PAN, Aadhaar (if linked), Date of Birth, and captcha

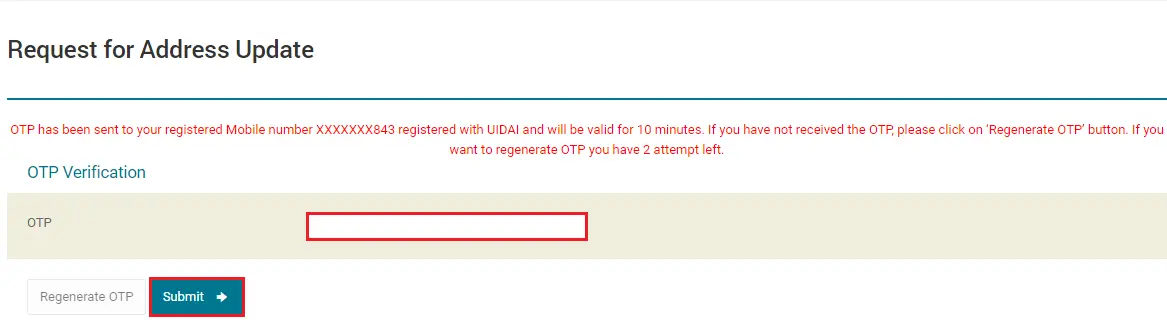

- 4Authenticate via OTP sent to your registered mobile/email

- 5Pay ₹8.26 (if duplicate download)

- 6Download ePAN instantly in PDF format

UTI PAN Card Download Telangana

UTIITSL also provides ePAN downloads for PANs processed through its portal. Learn about UTIITSL PAN application process if you need a new PAN.

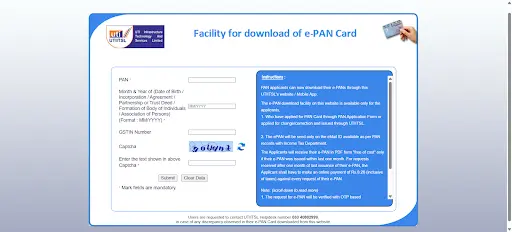

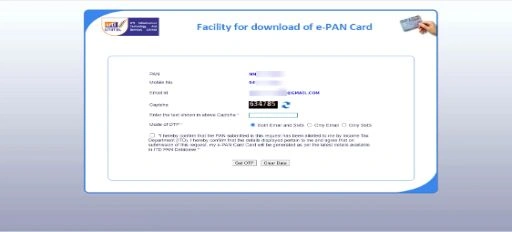

UTIITSL PAN Download Telangana Guide

- 1Visit the UTIITSL ePAN Portal

- 2Select "Download e-PAN" option

- 3Enter PAN, Date of Birth, and GSTIN (if available)

- 4Complete captcha verification and request OTP

- 5Pay applicable charges (if re-downloading)

- 6Download your ePAN instantly in PDF format

PAN Card Download by Name & Date of Birth Telangana

If you don't remember your PAN number, you can still retrieve and download it:

- 1Visit the Income Tax "Know Your PAN" Portal

- 2Enter Full Name, Date of Birth, and Mobile Number

- 3Authenticate using OTP

- 4Retrieve PAN details

- 5Use the PAN to download ePAN via NSDL/UTI portals

Aadhaar Card se PAN Card Download Telangana

If Aadhaar is linked with PAN, you can download your PAN card using Aadhaar:

- 1Visit Aadhaar-based PAN download service on the Income Tax portal

- 2Enter Aadhaar Number

- 3Verify OTP sent to Aadhaar-linked mobile number

- 4Download your ePAN instantly (free for first-time issue)

e-Filing PAN Card Download Telangana

Taxpayers in Telangana can also download their PAN card from theIncome Tax e-Filing portal.

- 1Login to the Income Tax e-Filing Portal with PAN and password

- 2Go to My Profile > PAN Details

- 3Authenticate with OTP if required

- 4Download your PAN card PDF instantly

Duplicate PAN Card Download PDF Telangana

If your PAN card is lost, stolen, or damaged, you can:

- Apply for a reprint via NSDL or UTIITSL portals

- Pay the applicable fee

- Download ePAN instantly while waiting for the physical card

Instant PAN Card Download Telangana

The Instant ePAN service is available for those who don't have PAN but have Aadhaar linked with a mobile number.

- 1Visit the Instant ePAN Portal

- 2Select Get New ePAN

- 3Enter Aadhaar Number and verify with OTP

- 4Download ePAN instantly in PDF format (free of cost)

Fees & Charges for PAN Download Telangana

| Service | Fee |

|---|---|

| ePAN Download (first issue via Aadhaar) | Free |

| Duplicate ePAN Download (NSDL/UTI) | ₹8.26 – ₹66 approx. |

| Physical PAN Reprint (Domestic) | ₹107 |

| Physical PAN Reprint (Foreign) | ₹1,017 |

Common Errors in PAN Card Download Telangana & Fixes

Important Notices for PAN Card Download Telangana

- Always use official portals like NSDL, UTIITSL, or Income Tax e-Filing to download PAN cards.

- Do not apply for multiple PAN cards — it is illegal.

- Ensure your Aadhaar, Name, and Date of Birth match before downloading ePAN.

- Keep your registered mobile number and email active for OTP verification.

- The ePAN PDF is digitally signed and legally valid — physical PAN is not required unless specifically asked.

- Save your downloaded ePAN securely, as it contains sensitive financial details.

Conclusion

Downloading PAN card online in Telangana is simple, fast, and secure. Whether you need a new PAN, duplicate, or correction, you can download ePAN instantly via NSDL, UTIITSL, Aadhaar, or the Income Tax e-Filing portal. Always use official portals and ensure your Aadhaar and PAN details are accurate for a smooth download experience.

FAQs — PAN Card Download in Telangana

Comprehensive answers to the most frequently asked questions about PAN card download in Telangana